Your guide to

Health4Me Claims

We created the following guide to help you understand how Health4Me claims work and

what information you need to submit a successful health insurance claim.

This guide has answers to the following questions..

- What information is required to submit a claim successfully?

- What are the payment run dates for Health4Me?

- Where can I find the claim forms for the hospital cash and funeral benefits?

- What is the claim process per department (points of contact and response times)?

Please take note of the following medical insurance claims processing steps that are needed for a claim to be successfully captured.

What information is required to successfully submit a claim?

Claim Forms

The hospital cash and funeral benefits require submission of the below claim forms. Please take note of the claim requirements as noted below.

Hospital Cash

Claim Requirements

- Fully completed Health4Me hospital cash claim form.

- Proof of hospitalisation (hospital account) stating admission and discharge dates.

- Medical certificate by treating doctor/physician/specialist stating reason for hospitalisation.

- Certified (by a commissioner of oaths) copy of the insured life’s identity document/passport/birth certificate.

- Certified (by a commissioner of oaths) copy of the child’s birth certificate (maternity lump-sum benefit).

- Copy of the insured life’s bank statement (not older than 3 months) or a cancelled cheque.

- Please note that ATM or internet statements are not acceptable.

- Additional information may be required.

- Claims not submitted within four months of the claim event will be rejected.

- Please submit the completed and signed form and any supporting documents, via email to health4meinsuranceclaims@momentum.co.za, or via fax to 031 580 0500.

Funeral

Claim Requirements

- Fully completed Health4Me funeral claim form.

- Certified (by a commissioner of oaths) copy of the insured life’s identity document/passport/birth certificate.

- Certified (by a commissioner of oaths) copy of the insured life’s death certificate.

- Certified (by a commissioner of oaths) copy of the BI 1663 (obtainable from the doctor who certified the death).

- Certified (by a commissioner of oaths) copy of the beneficiary’s/claimant’s identity document/passport/birth certificate.

- If the deceased child does not bear the same surname as the member, proof in the form of an affidavit of the relationship.

- If the deceased is a spouse, a certified (by a commissioner of oaths) copy of the marriage certificate.

- If the marriage certificate is not available, proof in the form of an affidavit that a permanent life partnership existed.

- Copy of the beneficiary’s/claimant’s bank statement (not older than 3 months) or cancelled cheque. Please note that ATM or internet statements are not acceptable.

- Additional information may be required.

- Claims not submitted within four months of the claim event will be rejected.

- Please submit the completed and signed form and any supporting documents, via email to health4meinsuranceclaims@momentum.co.za, or via fax to 031 580 0500.

Query Management

Please refer to the below table for the Health4Me claims and queries response process.

First point of contact: Reference number provided

Second point of contact: When feedback isn’t received within response time. Reference number needed.

All Claims Queries

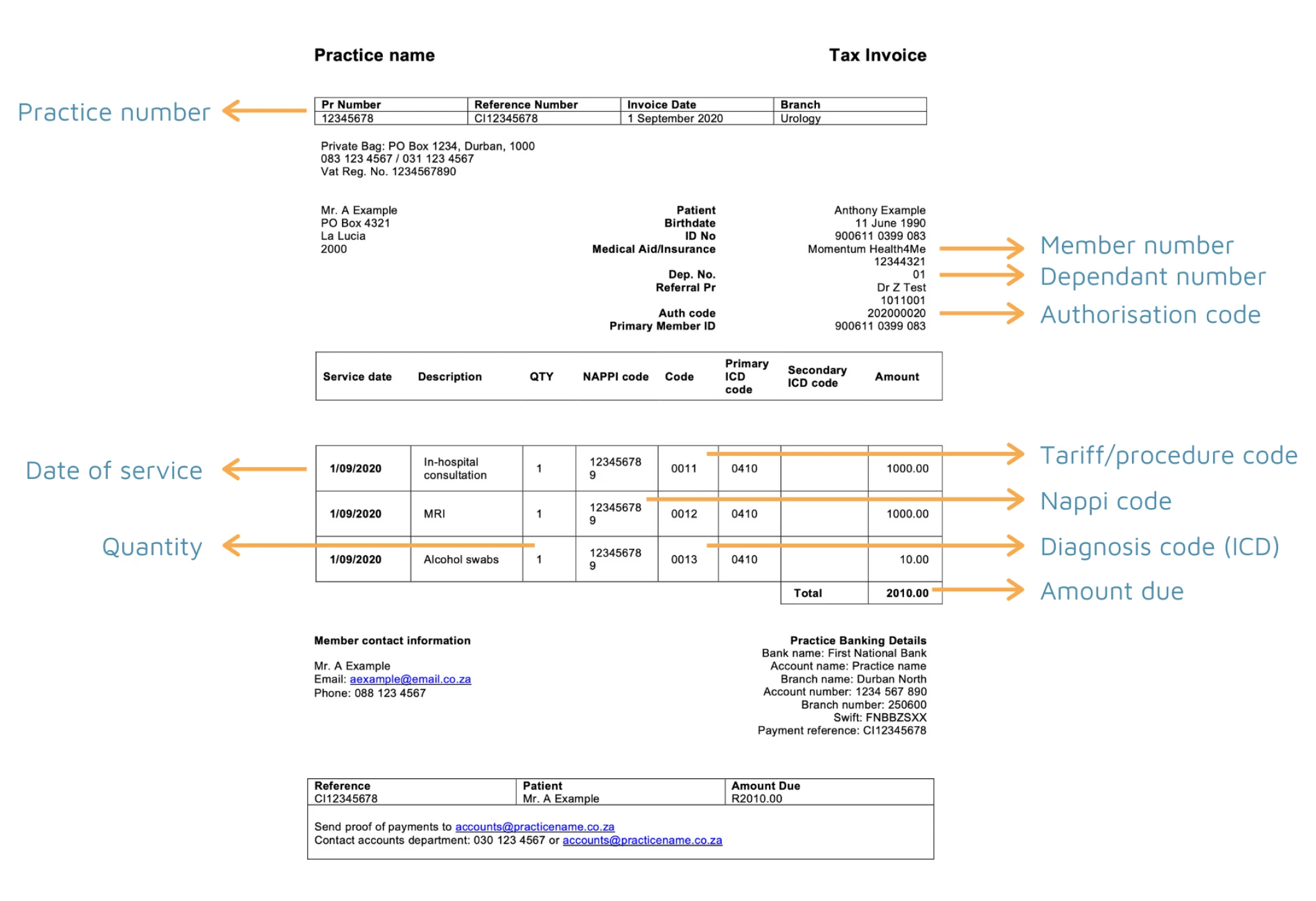

Required information:

Member Number

Practice Number

Date of Service

First Point of Contact

Response TimeQueries will be responded to within 2 business daysHealth4me@momentum.co.za

Second Point of Contact

Tel: 0860 10 29 03

WhatsApp: 0860 10 29 03

Day-day and Accident Claims submissions only

Please refer to the first tab, “Information required for claims”Please refer to our payment runs for 2023.

First Point of Contact

Claims will be reimbursed on Momentum Health4Me payment runs for 2023Health4meclaims@momentum.co.za

Second Point of Contact

Health4me@momentum.co.za

0860 10 29 03

Cash-back and Funeral Claims submissions only

First Point of Contact

Claims will be refunded between 5-7 business days from the date that all documentation is receivedHealth4meInsuranceClaims@momentum.co.za

Second Point of Contact

Health4me@momentum.co.za

0860 10 29 03

Member Refunds submissions only

Required information

Request to pay to principal member:

Details invoice (with member number)

ID copy of principal member

Receipt or proof of payment

Bank statement not older than 3 months or letter from the bank showing banking details

Request to pay to dependent or another 3rd party:

Details invoice (with member number)

ID copy of principal member

Receipt or proof of payment

Bank statement not older than 3 month or letter from the bank showing banking details

Other party’s ID copy

Principal member’s consent to pay other party

First Point of Contact

Claims will be refunded between 5-7 business days from the date that all documentation is receivedHealth4meRefunds@momentum.co.za

Second Point of Contact

Health4me@momentum.co.za

0860 10 29 03

Need Advice?

An accredited consultant will call you to discuss our medical aid options and benefits.

Your journey to quality healthcare starts here.

Get a quote now

We’ll call you back!

View our Privacy Policy

Health Insurance

Health4Me Bronze

Health4Me Silver

Health4Me Gold

Gap Cover

Gap Core

Gap Max

About

About Bloom

Frequently Asked Questions

Blog

Contact Us

Momentum Health4Me is not a medical scheme product, and is not a substitute for medical scheme membership. The information provided on this website does not constitute advice in terms of the Financial Advisory and Intermediary Services Act. Momentum is a division of Momentum Metropolitan Life Limited, an authorised financial services provider (FSP 6406) and a wholly owned subsidiary of Momentum Metropolitan Holdings Limited.

Bloom Gap Cover is not a medical Scheme. Products that are offered are not the same as that of a medical scheme.

© Bloom Financial Services 2025. Bloom Financial Services (Pty) Ltd is an authorised financial services provider (FSP 50140). Bloom Gap is underwritten by Infiniti Insurance Limited a licensed non-life insurer and an authorised financial services provider (FSP No.35914)

Privacy Policy